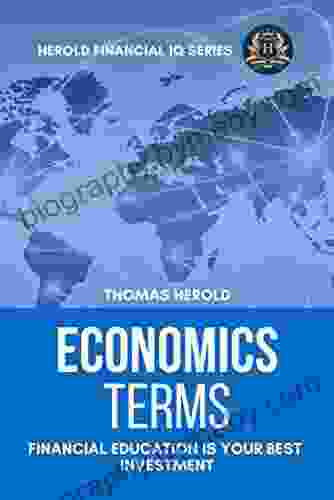

Unlocking Financial Freedom: Economics Terms - Your Key to Financial Literacy

In the realm of personal finance, knowledge is power. Understanding the language of economics is crucial for navigating the complex world of money, investments, and financial planning. This article aims to provide a comprehensive guide to essential economics terms, empowering you to make informed decisions and secure your financial future.

The Importance of Financial Literacy

Financial literacy is the ability to understand, manage, and grow your money effectively. It's not rocket science, but it does require a solid grasp of basic economics concepts. These concepts help you:

4.6 out of 5

| Language | : | English |

| File size | : | 570 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 319 pages |

| Lending | : | Enabled |

*

*

*

*

With the right knowledge, you can take control of your finances, create wealth, and live a more financially secure life.

Essential Economics Terms for Financial Education

1. Aggregate Demand

Aggregate demand refers to the total demand for goods and services within an economy. It represents the amount of spending that consumers, businesses, governments, and foreign entities are willing and able to make.

2. Budget

A budget is a plan that outlines your income and expenses. It helps you manage your money, set financial goals, and track your progress towards them.

3. Consumer Price Index (CPI)

CPI is a measure of inflation that tracks the prices of a basket of goods and services commonly Free Downloadd by consumers. It helps economists understand changes in the cost of living and adjust policies accordingly.

4. Currency

Currency is the form of money used in a particular country. It serves as a medium of exchange, store of value, and unit of account.

5. Deflation

Deflation occurs when the general price level falls over time. This leads to a decrease in the cost of living and an increase in the value of money.

6. Demand

Demand refers to the desire and willingness of consumers to Free Download goods and services at a given price. Factors that influence demand include income, tastes, preferences, and expectations.

7. Depreciating Asset

A depreciating asset is an asset that loses value over time. Examples include cars, appliances, and computers.

8. Economic Growth

Economic growth refers to an increase in the production of goods and services within an economy. It is typically measured by Gross Domestic Product (GDP).

9. Elasticity

Elasticity measures the responsiveness of one economic variable to changes in another. For example, price elasticity measures how much demand for a product changes when its price changes.

10. Equilibrium

Equilibrium occurs when there is a balance between supply and demand in a market. At equilibrium, the quantity of goods and services supplied equals the quantity demanded.

11. Fiscal Policy

Fiscal policy refers to government spending and taxation policies. Governments use fiscal policy to influence the economy and achieve economic goals such as full employment and price stability.

12. GDP (Gross Domestic Product)

GDP measures the total value of all goods and services produced within a country over a given period. It is a key indicator of economic growth.

13. Inflation

Inflation occurs when the general price level increases over time. This leads to a decrease in the value of money and an increase in the cost of living.

14. Interest Rate

Interest rate is the cost of borrowing money. When you borrow money, you pay interest to the lender. When you save money, you earn interest on your savings.

15. Investment

Investment refers to the use of money to Free Download assets that are expected to generate income or increase in value over time.

16. Liability

A liability is an obligation you owe to another party. Examples include loans, mortgages, and unpaid bills.

17. Liquidity

Liquidity refers to the ease with which an asset can be converted into cash. Cash is the most liquid asset, while real estate is less liquid.

18. Marginal Utility

Marginal utility is the additional satisfaction or benefit gained from consuming one more unit of a good or service.

19. Money Supply

Money supply refers to the total amount of money in circulation within an economy. It is influenced by central banks and commercial banks.

20. Opportunity Cost

Opportunity cost refers to the value of the next best alternative you give up when you make a decision. For example, the opportunity cost of buying a new car is the value of the next best way you could have spent that money.

Putting It All Together: How to Increase Your Financial IQ

Mastering these economics terms is not simply a matter of memorization. It's about understanding the relationships between these concepts and how they impact the financial world. Here are some tips to increase your financial IQ:

* Read: There are numerous books, articles, and websites that can help you learn about economics. * Attend workshops and seminars: These events can provide valuable insights and networking opportunities. * Practice: The best way to learn is by applying what you've learned. Create a budget, track your expenses, and research investments. * Talk to a financial advisor: A qualified financial advisor can provide personalized advice and help you develop a comprehensive financial plan.

Financial literacy is an essential life skill that empowers you to make wise decisions about your money and achieve your financial goals. Understanding economics terms is a key step towards increasing your financial IQ and taking control of your financial future. Remember, the journey to financial freedom starts with knowledge. Embrace the opportunity to learn and grow, and unlock the power of financial literacy.

4.6 out of 5

| Language | : | English |

| File size | : | 570 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 319 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Arous Brocken

Arous Brocken Anthony Dalton

Anthony Dalton Gordon Korman

Gordon Korman Nick Holt

Nick Holt Antoine Savine

Antoine Savine Anne Evers Hitz

Anne Evers Hitz Jimmy Song

Jimmy Song Herbert Tabin

Herbert Tabin Arlene S Bice

Arlene S Bice Arndt Sorge

Arndt Sorge Michael J Mauboussin

Michael J Mauboussin Theodore Menten

Theodore Menten Lawrence A Cunningham

Lawrence A Cunningham Camilla Trinchieri

Camilla Trinchieri Clare Goodwin

Clare Goodwin Anthony Everitt

Anthony Everitt Annie Gray

Annie Gray Annie Barrows

Annie Barrows Luke Colins

Luke Colins Annette Gordon Reed

Annette Gordon Reed

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ernesto SabatoStreet King Dream Street Dreams Series: Dive into the Urban Fantasy Adventure

Ernesto SabatoStreet King Dream Street Dreams Series: Dive into the Urban Fantasy Adventure Jaden CoxFollow ·10.6k

Jaden CoxFollow ·10.6k Ryan FosterFollow ·13.7k

Ryan FosterFollow ·13.7k Roald DahlFollow ·7.2k

Roald DahlFollow ·7.2k Chad PriceFollow ·11.4k

Chad PriceFollow ·11.4k John KeatsFollow ·13.6k

John KeatsFollow ·13.6k Anthony WellsFollow ·5.6k

Anthony WellsFollow ·5.6k Alan TurnerFollow ·2.5k

Alan TurnerFollow ·2.5k Stuart BlairFollow ·12.4k

Stuart BlairFollow ·12.4k

Juan Rulfo

Juan RulfoThe Easy Ingredient Ketogenic Diet Cookbook: Your...

Embark on a culinary adventure that...

Zachary Cox

Zachary CoxDepression Hates a Moving Target: A Groundbreaking...

Depression...

Colin Richardson

Colin RichardsonUnleash Your Spine-Tingling Curiosity: Dive into the...

In the realm of...

Evan Hayes

Evan HayesMarketing Fashion Portfolio: The Ultimate Guide to...

In the competitive world of fashion, it is...

4.6 out of 5

| Language | : | English |

| File size | : | 570 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 319 pages |

| Lending | : | Enabled |